The TL;DR* of this article

*Too Long, Didn't Read

- Beginner

- Intermediate

- Advanced

Post Summary

What Needs to be Done Before a Recession Hits?

Get an outside perspective and invest in ongoing employee education.Waiting to Plan Your Recession Business Strategy Is Dangerous

Keep the economy in perspective and do the hard work before times get tough.What Organizations Have Done in the Past to Pull Through a Recession

Invest in CX over R&D, acquire talent and refine the 3 Ps — people, processes and platforms.What Happens When You Emerge From a Recession With a Laser Focus on CX

Customers notice when you are actively improving the buying experience. Learn to listen and adapt.

One of the hardest topics for executives to talk about is their company’s recession business strategy. Utter the word recession around a boardroom table and you’ll likely hear a collective groan. Conversations about the implications of a future economic downturn are usually approached begrudgingly and with a “hopefully we never have to deal with that” kind of attitude.

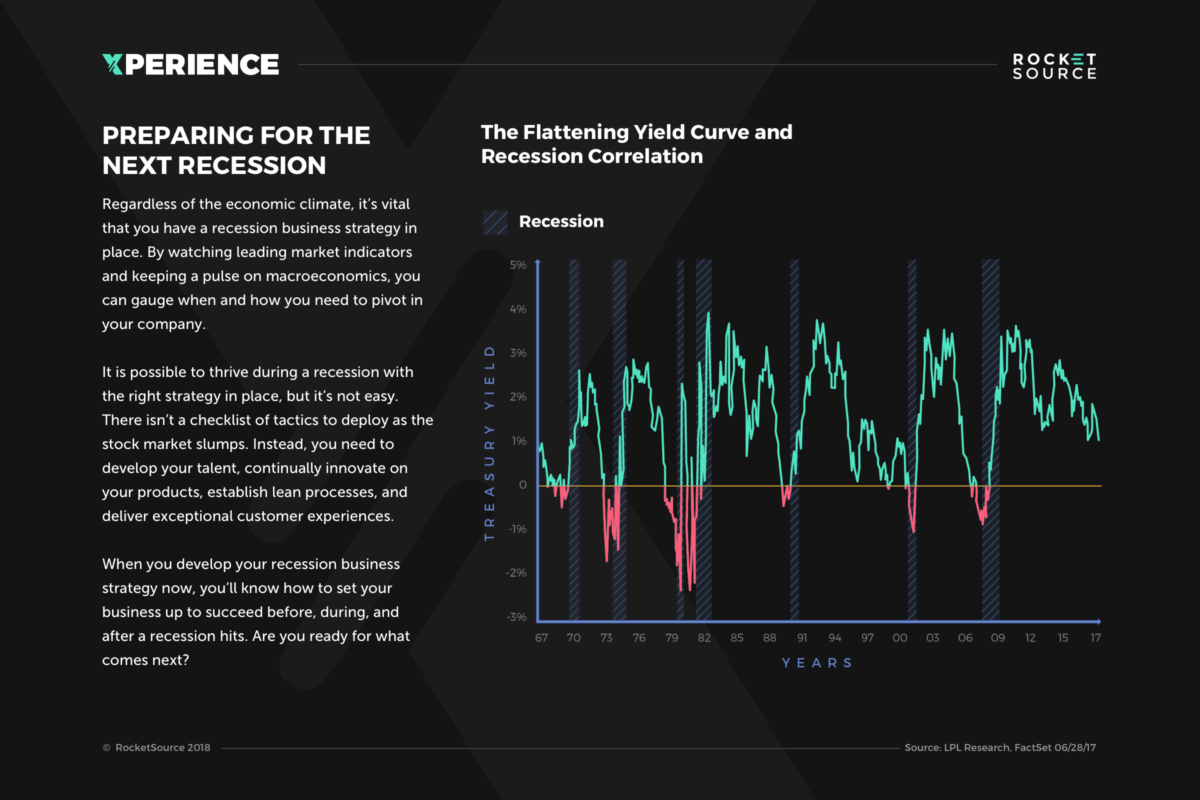

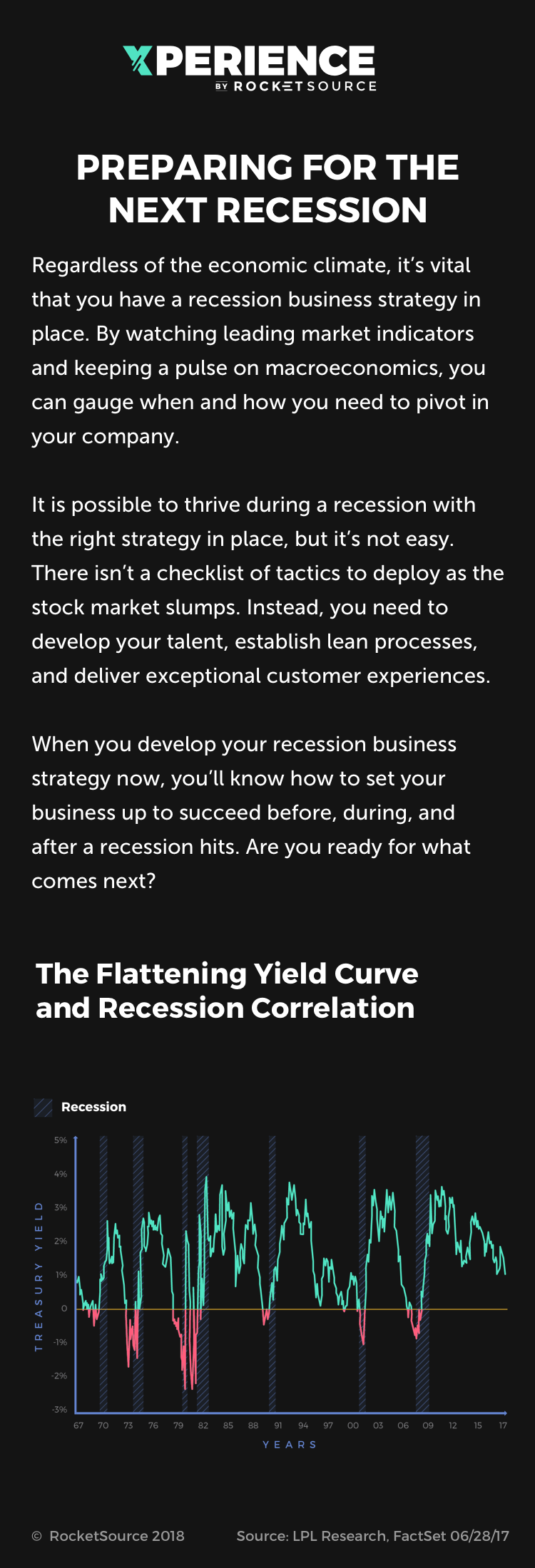

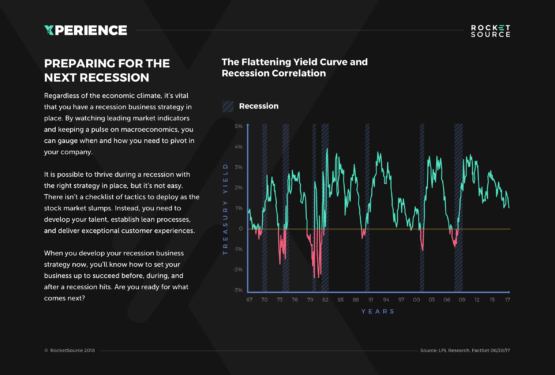

Few things suck the air out of a room faster than economic catastrophe, and yet I’ve been itching to write about recession and how it pertains to business strategy for a while now. Call me crazy, but I love a challenge, and recession-related matters are definitely challenging. With the flattening of the yield curve making headlines, and amid threats about the possible implications of increasing hiked interest rates, I know it’s time to get this information out into the world.

In this post, I’m going to tackle the things you need to do today to prepare for a recession, how you can spend strategically during a recession and what it looks like to emerge successfully after adopting intelligent CX initiatives. To do this effectively, you must understand the macroeconomics behind anticipating and preparing for a recession.

The Correlation Between Business Recession Strategy and the Yield Curve

There are tons of lagging macroeconomic indicators out there such as unemployment rates, interest rates and the consumer price index (or inflation rates). These indicators are great in their own way, but they typically come too late to allow forward-thinking businesses enough time to strategize and pivot when necessary.

Leading indicators are a little different. They come ahead of major changes, giving businesses time to shift gears and make strategic moves that’ll enable them to withstand the upcoming economic climate — regardless of what it might look like. One leading indicator I and many leading economists trust for deep insights, and therefore keep a close eye on, is the flattening U.S. yield curve.

If you’re not familiar with the yield curve, you should be — especially if you’re tasked with any aspect of the growth of your company or if you make budgetary decisions to the tune of millions of dollars. That’s because the yield curve can help gauge potential economic outcomes that could have a direct impact on your profit margins.

The yield curve is a line that showcases the current interest rate environment based on bonds and securities. When it goes up, it signals a chasm between the interest rates of long-term and short-term debt instruments. This steepening of the yield curve typically means the economy is strong and inflation rates are about to rise. On the flip side, when it’s flattening, the chasm between long- and short-term interest rates is narrowing. An inverted curve, in which short-term interest rates are higher than long-term bond interest rates, is foreboding.

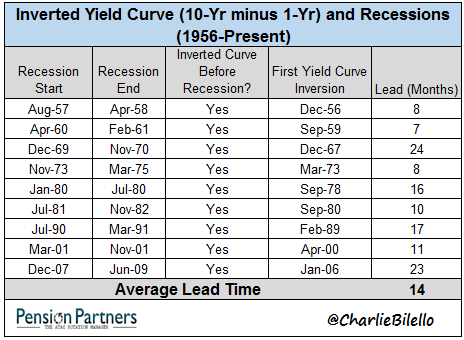

Historically, an inverted yield curve has been a strong signal that a recession could be right around the corner. In fact, negative yield curves have predicted the last nine U.S. recessions. This inverted yield curve-to-recession correlation chart shared by Charlie Bilello on the professional knowledge swap platform Seeking Alpha does a good job of showing just how effectively inverted yield curves have been at forecasting a recession. Pretty telling, right?

Take a closer look at the timing of the yield curve inversion in the chart above. In the 1960 recession, the yield curve inverted only seven months before the recession hit. In the recessions of 1957 and 1973, the yield curve inverted only eight months before recession hit. These aren’t tremendous lead times, especially for the number of preparations required to set up your business to pivot strategically and minimize the risk of experiencing the well-known, punch-in-the-gut outcomes that so often happen during a recession.

You can’t wait for the yield curve to invert before deciding on your recession business strategy.

Waiting for the yield curve to invert is the equivalent of waiting for the first raindrops to fall. This approach won’t leave you enough time to solidify your ideas and create a recession-proof business strategy, making it much harder to pull through an economic catastrophe successfully. Watching for a flattening yield curve is one of the best ways to get a leading prediction that a recession could hit soon. Knowing how it comes, how to speak articulately about it and how to democratize a preparedness approach for your organization will not only help insulate your business strategy against a recession— you’ll personally be seen within your team and organization as the forward thinker who “gets it.”

Before you hunker down too tightly, take a look at this video from one of my favorite economists, MKM Partners’ Michael Darda. He’s a brilliant strategist — one of the best on the planet — who’s hit the nail on the head many times over the years. This time he’s suggesting that we shouldn’t worry just yet about the potential implications of the flattening of the yield curve, but rather when the yield curve will invert due to additional tightening by the Fed.

Remember that, historically, an inverted yield curve has been the economic equivalent of a giant flashing yellow warning light for key business leaders and stakeholders. And yet, in the opinion of a renowned economic strategist like Darda, the flattening yield curve will only become a problem if the Feds continue to hike interest rates. Look at other headlines, however, and you’ll likely see that the Federal Reserve’s tightening cycle seems to be continuing at full steam. Analysts believe that the Fed is planning to hike interest rates again, which is an ominous sign that the yield curve could invert.

Although dark economic storm clouds appear to be building, Darda’s advice is sound. The flattening yield curve is just a predictor that a recession could happen, so the time to start planning is now. You shouldn’t wait for an inversion before acting.

The key to a strong recession business strategy is to monitor the economic climate and pivot at just the right time without losing momentum. – Buckley Barlow

Another economist I follow is David Ader, Chief Macro Strategist at Informa Financial Intelligence, who was ranked as the top U.S. government bond strategist by Institutional Investor for 10 years running. He said about the yield curve, “Yes, the curve hasn’t inverted, but I suggest that there’s no absolute need for an inversion to precede a recession.” According to Ader, various pressures on long-term bond rates could cause long-term yields to stay slightly above short-term yields, meaning that it’s possible to have a recession without an inversion.

Economic predictions are notoriously complex in nature. When it comes to making key decisions for RocketSource and for my notable clients, I don’t bet my marketing dollars on what’s happening with the yield curve alone, but rather rely on a slew of factors. The flattening yield curve is one data point that’s caught my eye, but there’s so much more out there.

In some cases, lagging indicators in a post-boom market can actually become leading indicators that end up fueling other economic data. For example, I often look at price-to-earnings ratio (P/E ratio) as a means of anticipating what will happen economically, especially after notable IPOs — when VC-backed private companies go public. I consider P/E ratio because people buy stocks based on a company’s predicted future performance rather than on past sales. Therefore, the stock market can sometimes signal whether the economy is strong or is on the decline. Another take on P/E is when valuations are way too frothy to be sustained.

Consumer spending is another indicator that tends to move in tandem with business success, so I consider various spending tendencies as they pertain to human behavior. One area I pay particular attention to is the real estate market. Declining investments usually signal a decline in consumers’ confidence as well. People hold onto their money more tightly because they’re looking for more stability or liquidity. This, aligned with other leading factors, could indicate that a recession might be on the horizon.

Macroeconomic insights, such as the flattening yield curve, P/E ratio, reduced consumer spending trends and changing consumer behaviors are just some of the indicators that can help you guard against recession. You can use them at any time when deciding on your next strategic move or planning your recession business strategy. You can also use them to back up your ideas when presenting to peers and executives. They’ll help you determine when to go full throttle, when to pull back or even when to pivot.

You’re probably trying to get a grasp on the yield curve and the impacts it could have on your business, but let’s pause for a minute. These insights might not be as foreign as you think. You see the impact of these economic fluctuations in your daily life whenever you read your mutual fund statement or check mortgage rates when considering whether to buy a new home or refinance your current one. Just as they relate to your personal life, they can also translate into your professional role. When you know what these headlines mean and can pull together data points to support your assumptions, strategies and plans, you’re better equipped to position yourself as an exceptional leader among your peers.

Building the Framework of Your Recession Business Strategy

Dollars don’t increase infinitely. Keeping an eye on the economic landscape and analyzing what’s ahead for you and your consumers can help you know where to spend and when to pivot. Both as a leader in your company and as a consumer, you want to know where to go and how to adjust your spending so that you can be as profitable as possible. That’s where having a solid framework makes a lot of sense. When you take a step forward, you don’t want to feel as if you’re stepping in mud. You want to plant your feet firmly on a solid framework and walk with confidence knowing that the preparation you did yesterday will enable you to do a better job tomorrow. Part of that preparation is skilling yourself up on how the economy impacts business and market cycles.

There’s a book by Joseph H. Ellis that I pull down from my shelf before and during every recession. It’s called, Ahead of the Curve: A Commonsense Guide to Forecasting Business and Market Cycles.

In his book, Ellis argues that it’s not a lack of data that’s the problem when it comes to predicting the economy — it’s a lack of a framework for interpreting the data correctly based on context and research. Too many businesses rely on one-off data sets handed out at the beginning of each week to make pivotal and potentially life-altering changes. These one-off data sets fail to give context to what’s being presented. They fail to tell a bigger story about what businesses can do to come out on top.

For example, many senior-level teams I work with (barring financial departments) tend to look at their direct spending budget on a quarterly basis only. They’re so driven and focused on the now, they tend not to think macroeconomically about what’s happening in areas like the bond market or what higher interest rates could mean for their future budgets. Because of this, they struggle to see the bigger picture regarding their allocation of capital. It’s even more complicated when their North Star Metric(s) and key KPIs are so top-level (e.g., revenue growth) that they don’t give the deepened predictive insights the company really needs. Because of this disconnect — which could be the result of organizational silos — leaders invest in the wrong things, or worse, fail to invest in areas that will set them apart, either when the economy takes a turn for the worse or when it’s poised to roar out of a recession.

What Ellis presents — and what I’m a huge advocate for in all of my consulting work — is visualizing datasets over longer time frames. When it comes to recession business strategies, plotting out year-over-year insights can yield better strategies and ideas than plotting by quarter. This approach helps draw out seasonal effects and smooth over clunky monthly averages so you can see relative changes over time. It also enables forward-thinkers to prepare for massive growth when the time is right. It’s an excellent way to push out of stagnant or declining growth charts regardless of what the economic backdrop looks like.

Tapping into these economic-driven insights is not department-specific. It’s for every leader across the organization. Marketers are more apt to understand how to react to signs of change in consumer spending and allocate spend in the right ecosystems and at the right touchpoints, and make partnerships in areas that specifically hedge against a drop in leads, nurtures or conversions. Product Managers will learn to iterate on products in a way that rivals don’t see, thereby keeping the company more competitive and certainly more aligned and more attuned with their cohorts. This approach is not department specific. It’s for every leader across the organization.

People drive the economy by choosing when and how to spend. One of my favorite videos about the economy is by Ray Dalio. In it, he presents a simplified view of the economy and reinforces that it is driven by people. The video is 31 minutes long so I won’t blame you if you don’t want to watch it all now, but it’s a nice primer to help you wrestle with all of the macroeconomic changes happening today. For the sake of this post, here’s my takeaway from Dalio’s video and the reason I bring it up: while doing an in-depth analysis of the economy, the key to understanding is to remember what too many forget — the economy is not an autonomous, mysterious entity. Rather, it’s made up of and driven by people just like you with motivations just like yours. Deals made between businesses are really deals made by people within those businesses. This is why having vested relationships with employees, partners and consumers is so paramount to growth. That personalized vesting, coupled with a curious understanding of how to put all the little pieces of a larger puzzle together, is so critical that it’s a part of our HR process at RocketSource. Perhaps that’s one of the core reasons we’re a small firm and yet have clients all over the world.

You can see now that having a recession strategy doesn’t mean having a simple backup plan for periods when revenues taper off. It means having an established, reliable framework that works against any economic backdrop to extract insights from consumers, macroeconomic trends, and internal data, such as your customer journey analytics. The framework that answers this lofty demand, and that I have used to grow numerous businesses, is StoryVesting.

StoryVesting: A Framework for Every Economic Backdrop

Dips are not easily forecasted — even when you look at leading indicators like the yield curve. When economic and stock market cycles go in a downward motion, no one gets a free pass. Out go the pay raises, job security, relocation packages and budgets and in come losses of revenue and momentum. This standstill is what scares many CEOs — and rightfully so. To keep your business on track, you must align the two core groups of people in your business — your employees and your customers — before recession hits. That concept of alignment is the foundation of my StoryVesting framework.

StoryVesting is the data-driven, customer-centric framework that I’ve used for years to grow my clients’ businesses, and it’s the one we teach in our workshops as well as to every new employee who walks through our doors. It’s based on predictive consumer psychology and is infused with humanized data. This intelligent growth and innovation framework lets you understand where shifts need to happen, where opportunities are being missed and how to mitigate risks associated with economic downturns. We’re solving complex problems with this approach, and recessions are no exception.

Until now, I’ve hit you hard with economics, but this isn’t a post on macroeconomic theory. Yes, looking closely at economic drivers can help inform how close we are to a recession and what consumers are thinking and feeling as a result. But if you set up your business the right way, you won’t have to worry excessively about many of the notorious repercussions of a recession, like plummeting revenue charts, slashed budgets or newsworthy layoffs. You can watch the news, hear about leading indicators like the flattening yield curve, and still breathe easy knowing that your business will not only survive but has the potential to thrive during a recession, regardless of when or where it happens. I might add that a little worry is healthy — but excessive worry is paralyzing to you, your teams and your organization as a whole.

Whether the recession hits next week or next year, you’ll never be remiss by preparing.

You can see then that the question isn’t whether to have a recession business strategy. The question is what can your organization do TODAY to plan for a recession so you’re not left fumbling when the next one hits.

How to Work On Your Recession Business Strategy Before the Economy Tanks

In my experience, the old adage that failing to plan is planning to fail holds true. As it relates to business, this means that a brand’s ability to successfully navigate an economic downturn will depend on the planning the company does leading up to it.

“Recession is opportunity in wolf’s clothing.” —Robin Sharma

A sound recession business strategy isn’t a list of tactics you can pull out of a hat as soon as the economy turns. It’s a comprehensive plan that includes proactive analysis and a strategic response to the economic backdrop at hand. Very few companies create this type of strategy, which is why so many are put through the wringer when a recession arrives.

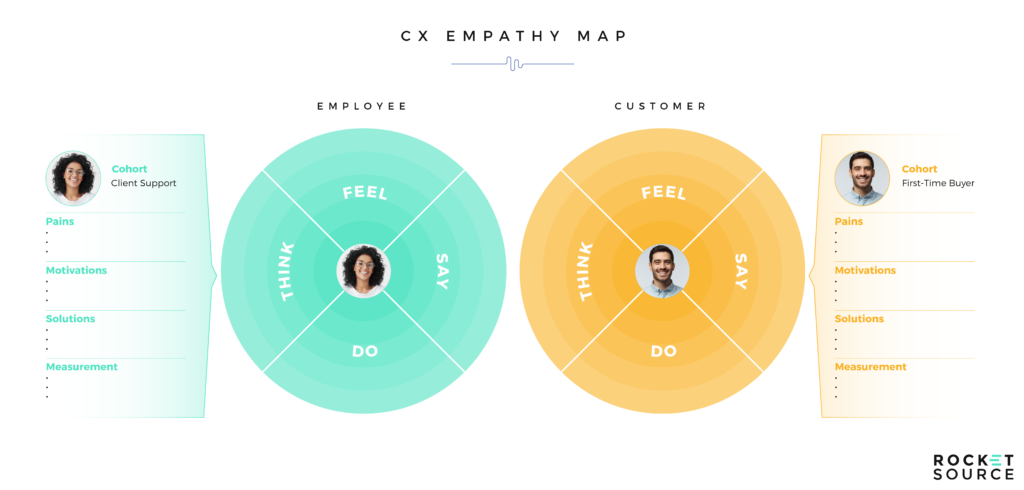

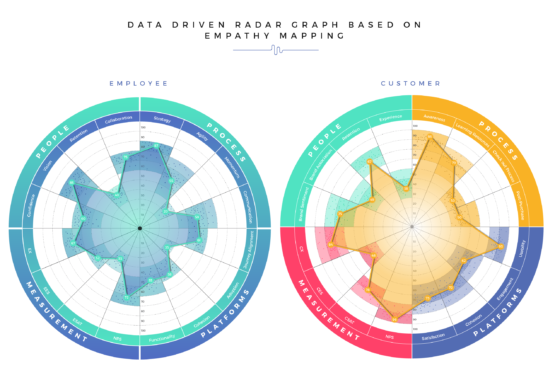

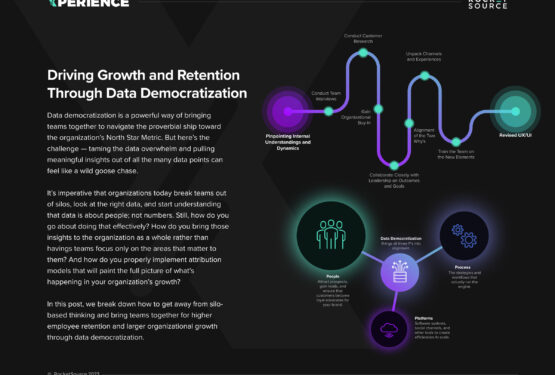

One of the core components of this plan is empathy. You’ve probably done some type of empathy mapping exercise in your organization in which you plotted out what you anticipate your customers think, feel, say or do. You’ve probably also written out some of their common pain points and motivations. This is a good start, but at RocketSource, we take this exercise many steps further by adding employee insights and metrics to the equation.

The first difference you’ll notice about our empathy map is that there are two circles instead of one. This is because there are two cohorts of people who are vital to your business’s success — your customers and your employees. By focusing on both cohorts, you’ll gain a better understanding of what your team needs to better serve your consumers.

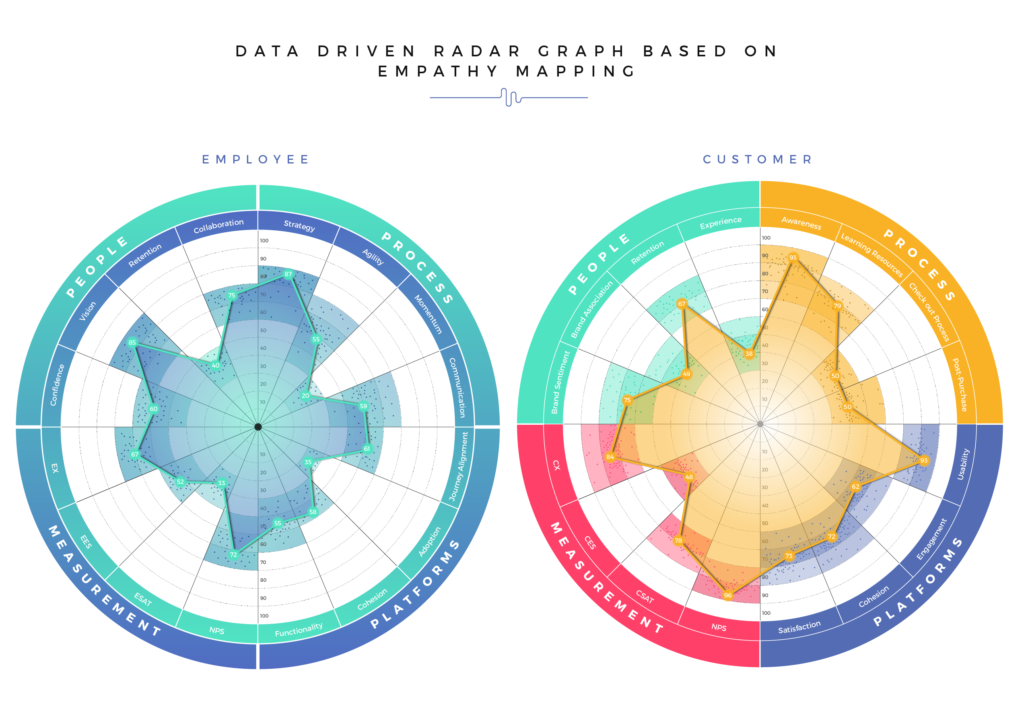

We also came up with 16 data points to signal how well you’re aligning with your employees’ and customers’ needs. We plotted the points on radar graphs to make these big, lofty concepts more data-centric and quickly understandable. Plotting out your data in this manner will help you quickly see how effectively your organization is meeting people’s demands. We go through how to do this in detail in our workshops because we’re firm believers in using data to validate assumptions and ensure that your perspective is accurate.

Perspective is an important element that’s not often talked about in business strategy but it should be. Without seeing the big picture, you could miss a substantial opportunity. With the wrong perspective, you could misunderstand your employees’ and customers’ needs, sending you in the wrong direction. To get a better understanding of just how important perspective is, take a look at this 30-second advert from The Guardian.

By gaining the right perspective using the insights that data provides, you’re in a better position to run a more “intelligent” operation — one that hits directly at the why of both your business and your customers. The better you align these, the more pointedly you can address your consumer’s concerns. Sales scripts are a good example. Leaving your customer support team to wing it on the phone with customers is dangerous. Instead, you want your team to take a strategic and empathetic approach when addressing people who are deciding whether to buy from you. Remember, people buy from people, so having your team operate from a place of empathy means you’ll increase the chances of winning your customer’s hearts, minds and wallets. To do this effectively, your sales scripts should match the empathy map you have in place for each cohort. That means having multiple sales scripts in place — one for each cohort— and a team trained to use these scripts effectively.

Taking an empathetic approach and digging deep to uncover what your consumers want from your brand will help you not only survive, but also thrive during a recession.

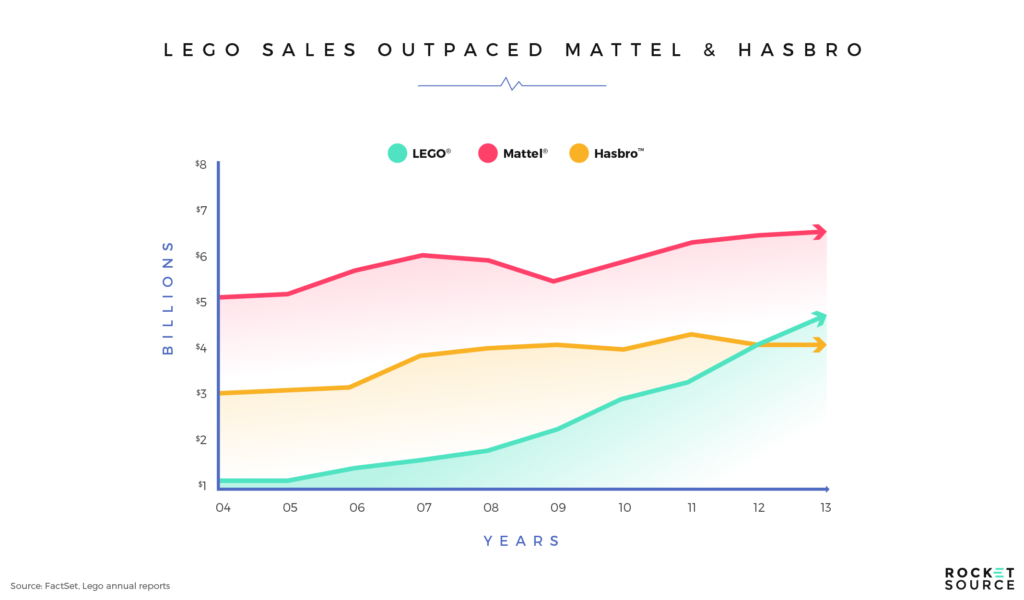

The toy brand Lego is one example. The toy industry was hit hard in 2008 and 2009, despite the fact that it’s typically considered recession-proof. While most toy manufacturers were scraping by in 2009 following a slower-than-expected 2008 holiday season, Lego’s profits went up by a third.

Why did Lego trend upwards when other major toy manufacturers’ sales either fell or leveled off? The company did a good job reacting to what consumers really wanted — toys with longevity. Lego understood that parents had limited disposable income. They used this insight to fine-tune their messaging to focus on promoting the durability of their classic toy blocks.

Again, gaining a deep understanding of buyers’ needs is hard. So often, we’re married to what we do for a living. If you’re anything like me, a self-proclaimed workaholic, you live, eat, and breathe your life’s work. This type of relationship with our job makes it hard to see the forest for the trees. We can’t innovate, invent, or improve because we’re stuck with our noses too close to the grindstone, making it impossible to see new opportunities and listen effectively to consumer demands.

There are many data collection, mining and modeling methods you can use to gather these insights. One quick way of uncovering potential opportunities is to get an outsider’s perspective by investing in assessments from a third party. As the founder of an innovative consulting and services firm, I’m obviously motivated to recommend assessments. From an objective viewpoint you can hopefully see how a third-party assessment benefits businesses. A good assessment won’t only be a springboard for new ideas, but will lay out your end-to-end customer journey so that you can identify areas of your business strategy that would benefit from a more empathetic approach. When economic catastrophe eventually strikes again — and it will — you’ll be better equipped to weather the storm.

How to React Strategically When a Recession Hits

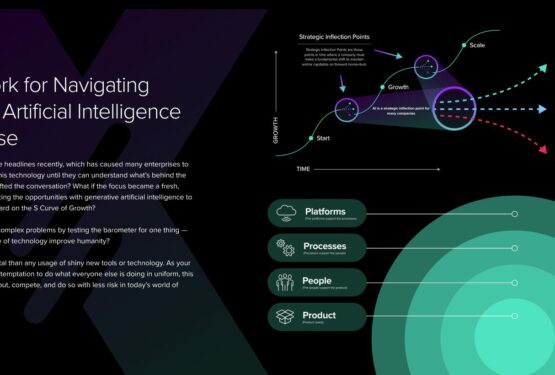

Every company, no matter how successful, faces strategic inflection points sooner or later. In these moments, momentum slows and key decisions have to be made to continue growing. I touched on these strategic inflection points in my post about the S curve of business. When you have a moment, I encourage you to read that article. For now, here’s the gist of it: to push your way through those moments when growth stagnates, you must pull the right levers to strategize, deploy and ultimately propel your business upward again.

During recessions, strategic inflection point strategies are a little bit different. This is because recessions drastically impact the whole economy, which forces many companies into inflection points at the same time. Consumer spending drops, the markets go crazy and companies react by panicking. Most economy-related headlines you’ll see during a recession are a result of this panic — layoffs, bankruptcy, high-interest borrowing, reduced venture capital funding and more doom and gloom. This doesn’t have to be the case for every organization, however. There are a lot of success stories that come out of recessions as well.

“I’ve heard there’s going to be a recession. I’ve decided not to participate.” —Walt Disney

Walt Disney got it right. Just because there’s going to be a recession again doesn’t mean you have to participate when it hits — and planning ahead is the key. By aligning your brand with your ideal customer’s wants and needs before, during and after a recession, there’ll be no reason to panic when economists speculate the implications of the flattening yield curve.

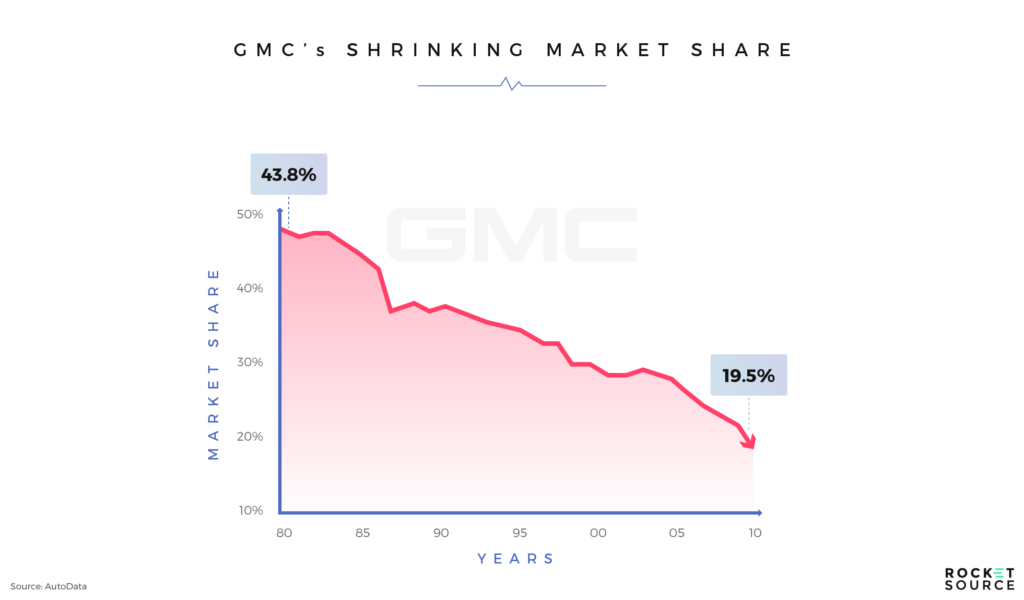

Let’s look at what happened in the car industry, which has been hit hard by recession twice — in 1990 and again in 2008. Prior to these recessions, the Big Three — GM, Ford and Chrysler — held the industry’s top sales spots. But as soon as the economy started to decline, so did sales, leading all three manufacturers to close manufacturing plants. Here’s a shudder-inducing sales chart from GM to give you some insight into what they were up against and why the U.S. government stepped in with a taxpayer-funded bailout loan.

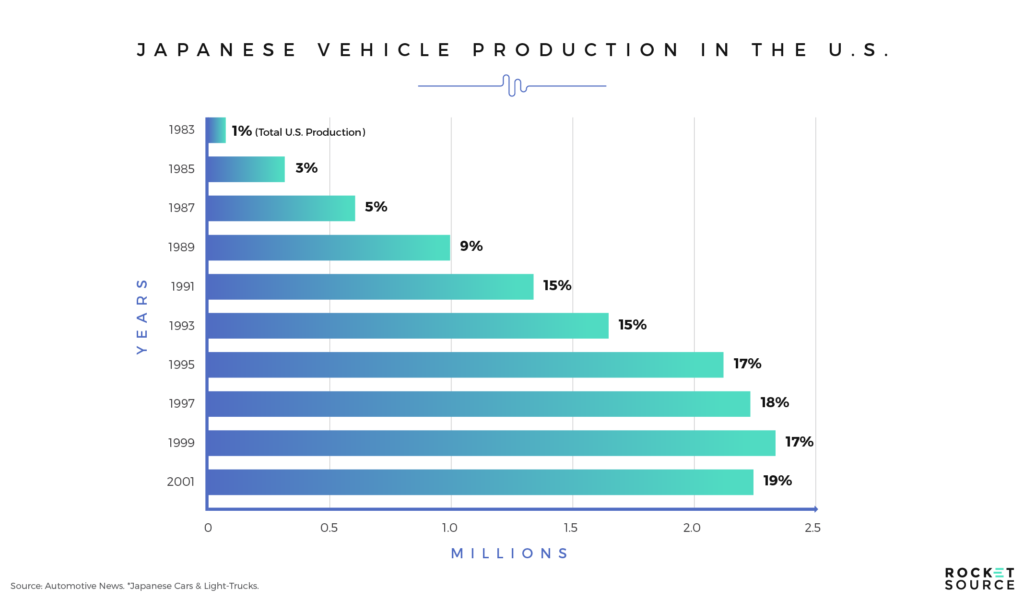

At the same time in the early 1990s, Toyota’s story looked dramatically different. Not only was Toyota not closing their plants, they were opening new ones. Production continued to grow during the recession in the 1990s and beyond. According to Yukitoshi Funo, head of the company’s North American operations at the time, “Toyota’s market share goes up during downturns.” In 2002, their sales rose by 4.6% over the prior year — the same time that the Big Three’s sales were falling.

But this success wasn’t exclusive to Toyota. Other Japanese automakers also experienced this growth trend occurring during the recession.

The reason Japanese automakers were ramping up production while American companies were slowing down boils down to positioning and focus. GM, Chrysler and Ford were largely known for assembly line efficiency, while Toyota and Honda were considered superior in durability and quality. Consumers overwhelmingly chose durable Japanese cars because they knew these vehicles would hold their value longer than their American counterparts. This wasn’t an accident. Japanese manufacturers made a strategic choice to align with customers’ concerns about durability.

Many companies today have the same problem GM, Chrysler and Ford had. They simply don’t have the right combination of talent, know-how and foresight to accurately forecast and prepare for recessions based on consumer insights. When they find themselves in forced strategic inflection points due to a recession, they falter rather than pushing through successfully. That’s because this stuff isn’t easy. As I mentioned earlier, there isn’t a simple hack or checklist to help you stay ahead of the competition, and anyone who says differently is selling something. Still, there are ways you can make it more manageable while mitigating risk.

I’ve built companies during recessions. I’ve experienced the pit in my stomach as I scrolled through the Apple News app on my iPad at night. I’ve been through the fears associated with these economic slowdowns and emerging from them I’ve found three things that help keep the growth machine moving in the right direction with momentum, even when consumer spending slows: 1) cutting back on R&D and reallocating funds, 2) looking to strategic acquisitions and acqui-hires and 3) refining the 3Ps around Customer Experience. Let’s look more closely at each of these.

1. Reallocate Funds From Research & Development to Customer Experience

Product innovation can tear your profit margins apart, especially during a recession. As you saw in the Lego and car manufacturer examples, consumers look for longevity and proven durability during a recession. New product development just can’t deliver enough of a promise for consumers to buy with confidence, so sales continue to slump. So where do you invest in growth if not with product innovation? You invest in experience.

“Welcome to the new era of marketing and service in which your brand is defined by those who experience it.” — Brian Solis

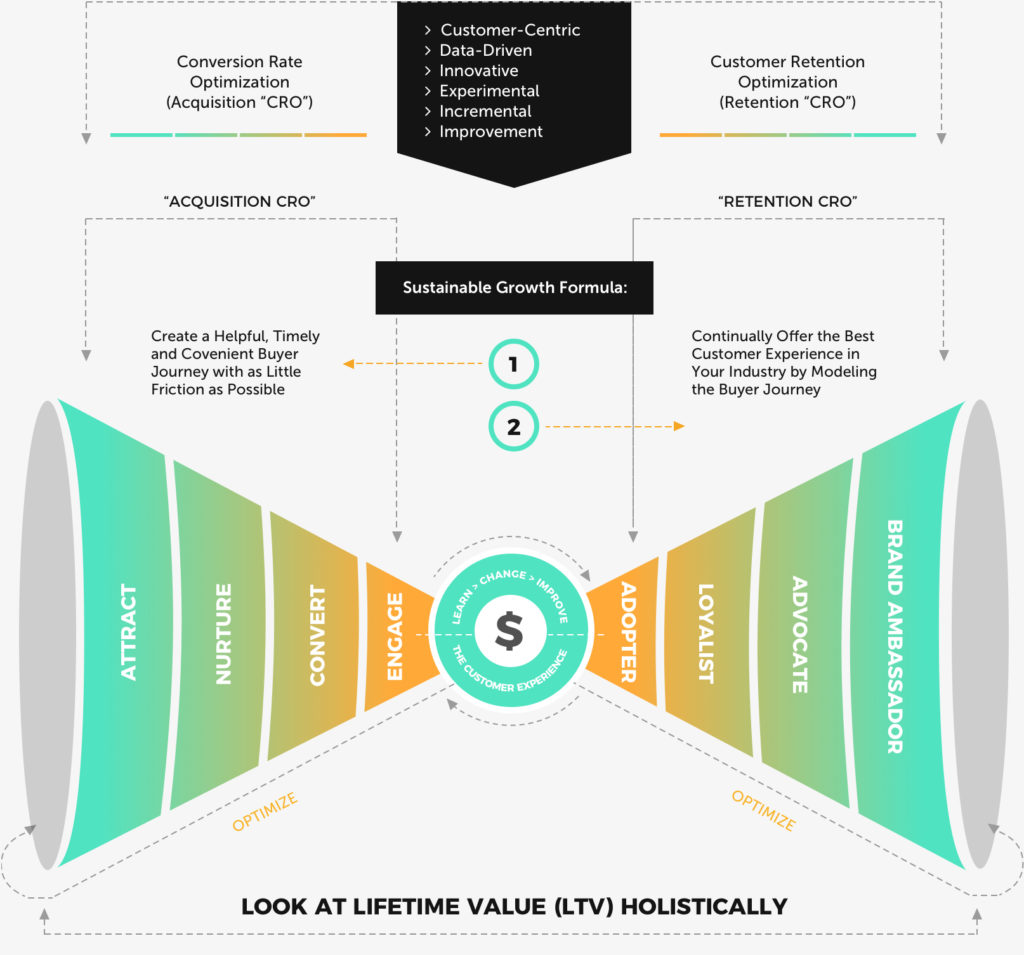

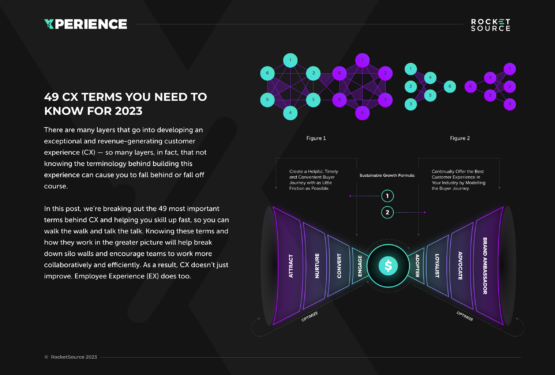

Gartner has long said that customer experience is the new battlefield and we wholeheartedly agree. 87% of customers think brands need to put more effort into providing consistent experiences, according to ZenDesk and LoudHouse. Customer experience (CX) initiatives drive revenues and build customer loyalty. This is the premise behind the rather sharp-looking bowtie funnel I designed.

I’ve dug in deep on this in my post about the bowtie funnel, so if this is new to you, I urge you to read this post and learn more about each of these stages. When you focus on delivering superior customer experience at every stage from awareness to brand ambassador, you’re investing in bolstering your loyalty loop.

Your loyalty loop — the holistic view of your marketing funnel — is the key to keeping customers aligned with, coming back to, and raving about your brand regardless of the economic backdrop. Investing in both customer acquisition and customer retention will optimize your business for growth, even when consumers are more hesitant to pull out their wallets. The key to doing this is to deliver a stellar experience — not shiny new features on your products.

2. Look for Strategic Acquisitions or Acqui-Hires

This might look like an odd suggestion after sharing the Hewlett Packard example above. It also might seem like a risky venture to take during a time that’s traditionally all about mitigating risk. But when done right, strategic acquisitions can have a tremendous impact on an organization during a downturn. The key word here is strategic.

The larger companies get, the more they rely on strategic mergers and acquisitions to grow. A McKinsey analysis found that between 1999 and 2010, 75% of the top 500 companies used active M&A programs to grow, and 91% of the top 100 companies used M&A for growth. This was certainly true of Verizon and Alltel.

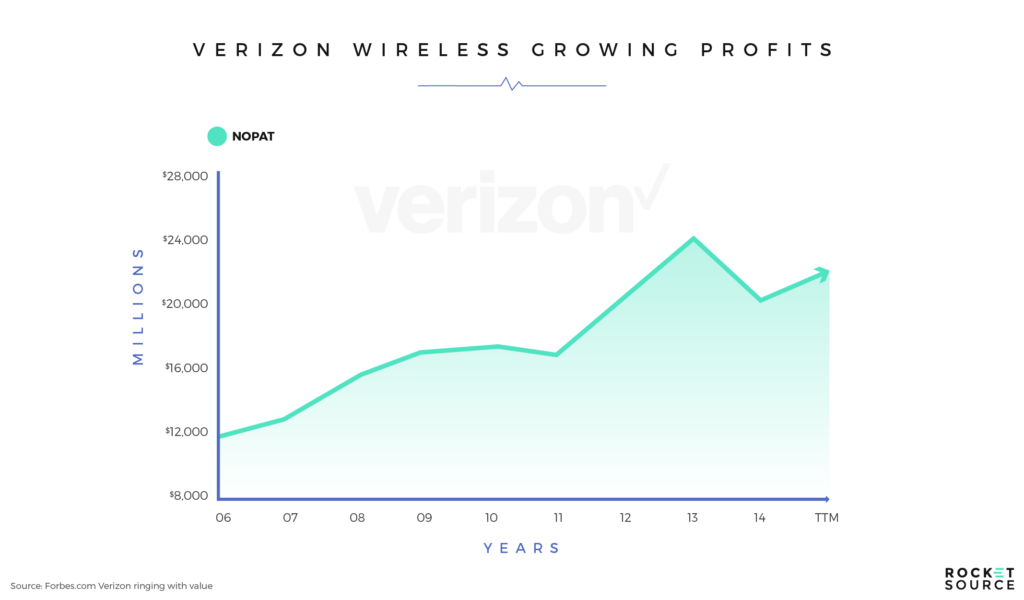

In 2008, in the middle of the recession, Verizon Wireless famously acquired Alltel for $28.1 billion. The strategy here was to become the largest Internet provider in the United States, bumping AT&T out of the top spot. The move proved to be a good one, as Verizon continues to see upward momentum as a cell phone service provider, even a decade later. As apps became a normal offering and more people started buying smartphones, Verizon saw the demand for more cell phone data service. They decided during a recession to make a strategic acquisition that would position the company at the top of the carrier list and allow them to deliver that data to more customers.

Verizon’s acquisition of Alltel was unique. Acquisitions tend to decline during a recession. For the most part, the 2008 recession resulted in a decline in this business strategy. Still, a global study by Towers Perrin and Cass Business School found that businesses that made strategic acquisitions during 2008 and 2009 tended to outperform their competition in market valuation. Businesses were able to pick up better deals, which in turn gave them better returns. In his final analysis David Hinkel, Senior Consultant in Towers Perrin’s M&A practice, concluded that “companies that are good at deals are always hunting for opportunities, and have systems and processes in place to move quickly for the right purchase. Repeat acquirers get better returns because they are resourced well, are flexible enough to react, and are clear about what will work strategically and culturally. That’s the recipe for success to which all companies need to aspire.”

The key here is to take a proactive stance instead of a reactive one. Be on the lookout for businesses that can push your company further, and when the timing and pricing are right, acquire them.

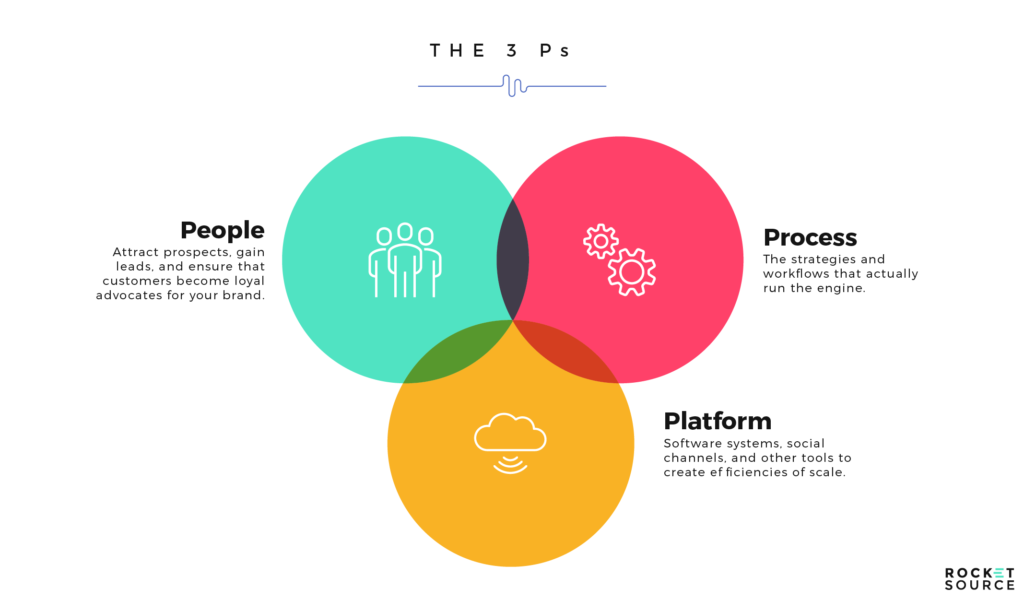

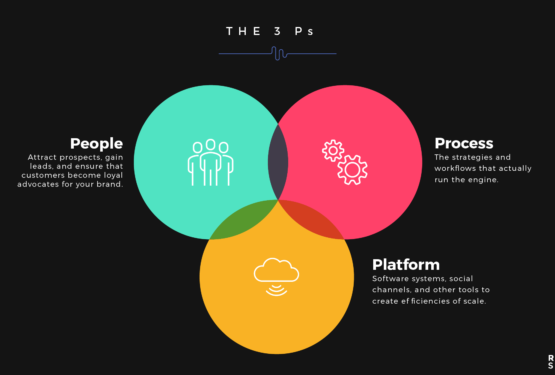

3. Refine the 3 Ps of Business

Slowing R&D and making strategic acquisitions are helpful tactics, but you can’t afford to ignore what’s happening at the core of your business. One of the most fundamental steps in ensuring your success before, during and after a recession is to focus on what I call the 3 Ps of business —people, platforms and processes.

No matter what the economy looks like, you should constantly be perfecting the way these work together. In recessions, however, they’re even more critical to your ongoing success. Let’s take a closer look at each of them.

People

Harvard Business Review analyzed 4,700 companies that went through the most recent recessions and found that companies focused on cutting their workforce had only an 11% chance of achieving breakaway performance post-recession. Their explanation for this makes sense — laying off employees lowers morale. When morale plummets, so does the ability of teams to feel vested in their business’s why.

As leaders, it’s critical to keep in mind the people we’re leading. They aren’t cogs in a machine but rather driven young talent or senior employees itching to remain relevant. They’re people striving to achieve success just like you and me. Also like us, they make mistakes. Responding with empathy at these times can strengthen their feelings of investment in your company — especially when it feels like everyone around them is crying out that the sky is falling. Your understanding of what they’re experiencing can be just the inspiration your team needs to stick around and help push you through an economic downturn.

Never forget the value of your most vested employees and customers… they’ll propel you out of a recession. –Buckley Barlow

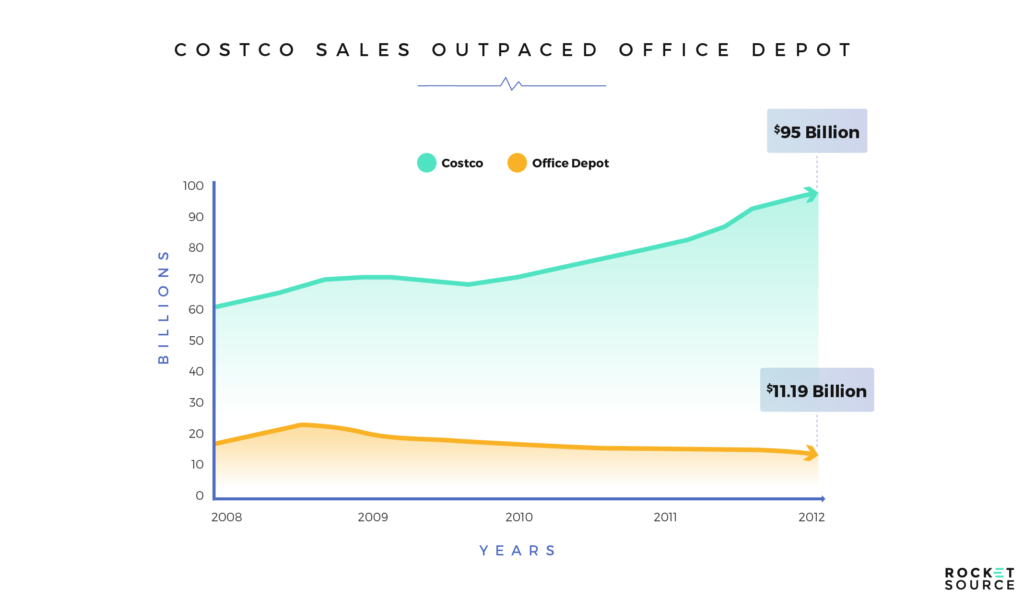

To demonstrate the important role vested employees play during a recession, let’s look at Office Depot. During the 2000 recession, they cut their workforce by 6% and tried to make up for the lower headcount by offering incentives to boost sales. It didn’t work. Growth fell to 8%, compared to the 19% growth they experienced pre-recession. They bled talent and thereby stifled the momentum they’d worked so hard to build in the marketplace.

Costco took a different approach. They were public about not laying anyone off during the recession. When asked why, CEO Jim Siegal said, “Our employees… deserve our loyalty.” That sentiment resonated with a lot of people — consumers and employees alike. Their sales proved that their investment in people was a solid one.

Take a look at this chart. Here, you can see the sales growth difference between Costco and Office Depot from the time the recession hit and beyond. A key part of Costco’s upward momentum was their dedication to their employees. Meanwhile, Office Depot continued to trend downward even after the economy improved.

This demoralization and the struggle to regain vested employees are the reasons I’m such an advocate for educating and rewarding your team during a recession. By investing in the people who make up your organization, you position your company to provide better experiences to customers. These experiences are what fuel growth during economic hardships.

Every time I see a recession on the horizon, I make sure I have a plan to skill up my employees in a meaningful and consistent way. It’s not a method to distract my workers from shaky economic times; it’s about planning for growth on the tail end of the recession and mitigating as much damage as possible during it. This training tactic allows for that in a couple of different ways. By training, you show your employees that you’re investing in them, which makes them feel more secure in their roles despite the tumultuous economic surroundings. Training not only improves employee morale but also prepares your company to regain strong momentum after the recession ends.

An educated workforce generates good ideas, can turn those good ideas into great products and processes, and is better equipped to make your customers happy.

You and your team must constantly equip yourselves with the brainpower to iterate and adapt to today’s rapidly changing market.To do that, you need to continue education. Educating employees, including yourself, keeps the focus on personal growth. This personal progress isn’t just valuable for your firm because of the new insights employees bring back. It also builds self-esteem and spurs feelings of security in an otherwise insecure time. Consistent personal growth makes everyone — you and your employees — feel vested in your business’s longevity and success.

There’s no downside to making your employees better. I’ve seen the educational approach pay off in improved morale and better overall brand experiences, which is why I am such an advocate for it. It’s also why we’re creating specialized workshops and training at RocketSource. It’s a solid approach to empowering your team to plant their feet in your culture and align themselves with the goals of your company.

Platforms

The platforms you use — to do your work, gather insights, manage projects and sell your products — matter. These are the tools your team and your customers interact with daily, so they have a direct impact on the experience people have with your business.

How you gather your data and where you act on it can make or break your business—especially during a recession.

Before, during and after a recession you need to use, review and — when necessary — change the platforms you use. Every time you analyze your current tech stack, you should look for platforms that let your teams effectively communicate and collaborate, as well as platforms that let your consumers buy from you with minimal friction. Without the right tools in place, your business will have a harder time surviving when the economy slows down.

Let’s revisit the car industry as a good example of the need for platforms to adapt over time. According to Google — a reputable source in my book — the average used car buyer visited five to seven dealerships when trying to find the perfect vehicle. Now they don’t even make it to two because consumers are using a new platform to shop for vehicles — the Internet.

CarMax saw buyers using this new platform and understood the importance of meeting the customer where they wanted to shop — online. To this end, they adapted their website and personalized all of the channels in their buyer’s experience. First, they innovated on their search functionality and figured out ways to use data to identify unique needs. Then, based on those insights, they personalized the messages their customers received online, on their mobile devices and ultimately in-store.

By analyzing your internal tech stack and comparing it to the technology consumers demand, you can improve the overall experience people have with your brand. That experience is paramount when consumer confidence is shaky and competitors are fighting for every consumer dollar.

Processes

Every time you take action in your business you set a process in motion. For example, when someone signs up for your email newsletter, you send them the first welcome email (if you’re not doing this, you should). this sets in motion a process of nurturing that person toward a sale. When a customer orders a product from your website, another process is set in motion. A phone call to the support department is another.

Inside the organization you have processes, too. Marketing, sales, support, IT and every other department each handle unique parts of the business differently. But here’s the thing — every internal process is a part of the greater sum of the end-to-end customer journey, meaning that every process reflects back on your brand in some way. As you break away from thinking of these processes individually and view them as a holistic experience, you can really start to gain momentum.

During a recession, your processes might need to shift. During the 2008 recession, one company that recognized this need and did well as a result was Ford. Their success was much due in large part to how they changed their operations during the economic slowdown.

Ford entered the recession struggling, along with the other American automakers. Before 2008 they had recalls, safety issues and slower sales. When their new CEO Alan Mulally took over, things changed. In 2009, Ford posted a net income of $2.7 billion, and in 2010, net income increased to $6.6 billion, their highest earnings in more than a decade. So how did they fuel their growth? They changed their processes. They identified bottlenecks and eliminated them. They cut high-cost models from their production line. And they worked hard to revamp their image in the industry. They looked at their processes holistically and made changes for the better.

At RocketSource, we help businesses tackle the 3 Ps by optimizing them for growth both in and out of a recession. We help companies shave down platform costs. We streamline bottlenecks in business processes. And we help people skill up to become more empowered and vested in a business. All of this is done with one goal in mind — to deliver the best possible experience to both employees and customers, no matter what’s happening in the economy.

Strategic Spending During a Recession

Each of these three factors — reallocating funds from R&D, looking for strategic acquisitions or acqui-hires, and refining the 3 Ps — are centered around one thing: knowing when to pivot on spending. This requires you to be forward-thinking.

Cost-per-acquisition (CPA) goes off the charts during a recession because companies spend so much money to attract new customers. The companies that succeed during a recession aren’t necessarily making more money — they’re pivoting to become more pragmatic about how and where they spend their money. The question then becomes, how do you accurately determine when it’s time to start spending during and after a recession?

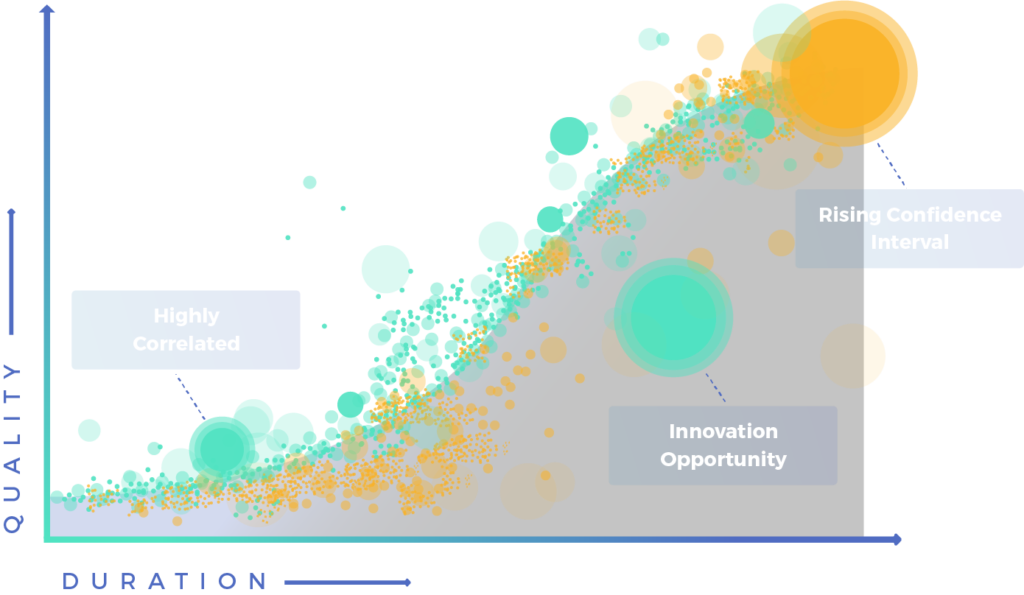

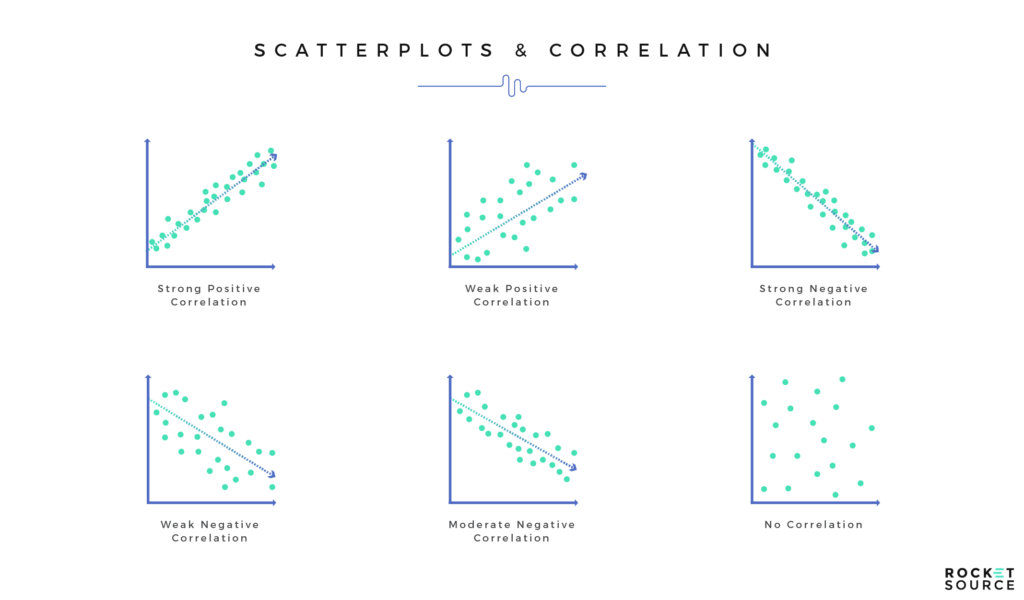

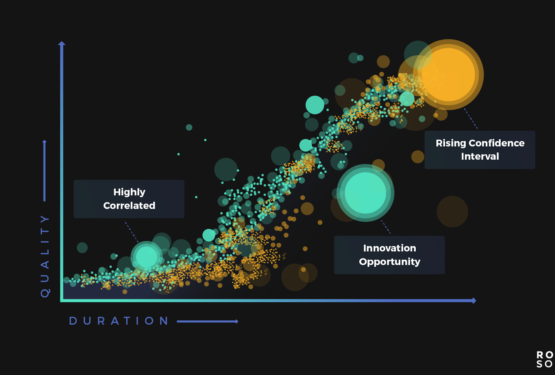

It’s incumbent upon leaders to use data to find that answer. To do this, we use correlation graphs.

As you map out your data points, you’re looking for a strong positive correlation between pre-recession and current data. For example, comparing pre-recession sales per cohort to current sales based on cohort will help determine whether they are increasing together (a positive correlation) and how strongly they’re aligned. Even a weak positive correlation might be enough to signal that it’s okay to pick up spending again.

By mapping these data points using a Customer-Centric data mapping process, you’ll have a clear indication of your customers’ spending habits and behaviors in the current economy. You can then use these findings to run fundamental IRR analyses to determine how to allocate for growth.

Tapping into your data is important because doing so validates your assumptions. It tells you whether what you’re guessing based on the current economic backdrop is true, and nothing is more critical than ensuring that “gut-feel” is quantified across an agile, fail-fast mentality.

You can compare managing budgets that are in the millions of dollars to building personal wealth. You have to spend money on the right things at the right time to grow your net worth. Doing this involves watching the news and predicting what your family’s household budget will look like in a month, a year or five years from today.

Business spending is no different. You have to pay attention to what’s happening economically to understand how consumers will react. Then, based on those insights, allocate your spending on the right channels, with the right technology, at the right time. Ultimately, when you go through this logical preparation and tactical execution, you’ll emerge from the recession armed with assets that’ll put you leaps and bounds ahead of your competition.

To illustrate this point, let’s look at Home Depot, whose stock tumbled recently after reporting weaker than estimated sales. Many blamed a delay in the arrival of warm weather in the Spring, but there’s likely more to this story.

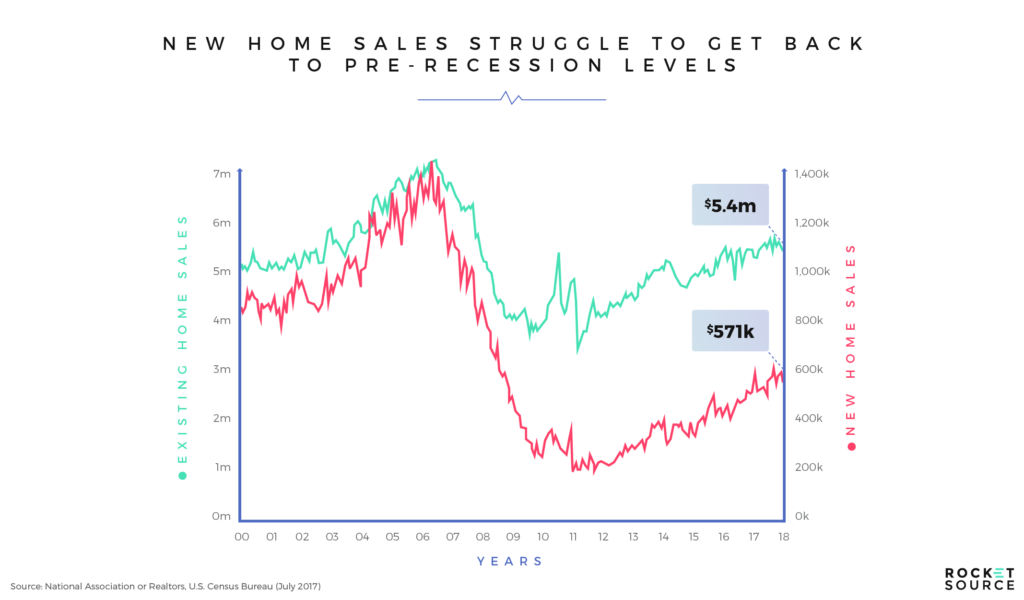

Millennials aren’t buying homes as previous generations have. Boomers are downsizing and consumers just aren’t spending as much as they used to overall. Zillow showcased a report illustrating that home sales haven’t bounced back to where they were before the 2008 recession.

Chances are, home sales won’t spike anytime soon either. That’s because talk of recession has started creeping back into the news and consumers are scared. They’re holding tight to their pursestrings and remembering how painful the last recession was.

A downward trend in the economy like this is a key indicator that it’s time to tweak budgets, change pricing models, revise loyalty loops, increase customer service and support, add additional technologies that’ll pull customers in, and make the business more visible. This is a good time for Home Depot to adjust their approach. For example, as consumers are hunkering down for a recession they’re spending less on home improvement projects and are likely more focused on googling “do it yourself” projects instead. With that in mind, Home Depot might do better by promoting projects like pantry remodels over kitchen remodels. Or they might place a heavier emphasis on promoting their classes to appeal to consumer preferences for DIY projects in lieu of full remodels.

By analyzing the correlation between pre-recession and mid-recession data points, businesses will have a better idea of when and where to pivot. In doing so, they’ll be better equipped to appeal to their customers’ fluctuating needs.

What Happens When You Emerge From a Recession With a Laser Focus on Customer Experience?

Becoming experience-centric today will position your business to not only survive the economic downturn but to come out ahead and with a set of strong assets under your belt. I’m not talking about assets like faster printers or a treadmill desk — I’m talking assets that will give your entire business a nice, gusty tailwind as the economy enters smoother waters. Let’s look at a few assets that will be on the table when you put CX, both first before and during an economic downturn.

As you adjust your spending and adopt brand experience (BX) initiatives during economic hardship, you will ultimately come out of the recession with a more loyal customer base. Lifetime Value (LTV) will likely go up and churn rates will likely go down. And, as customers emerge from the recession and start loosening their purse strings again, that loyalty gives you a head start on the competition.

With more strategic spending and a core base of loyal customers, you’ll also likely have more cash on hand and a strong credit balance while businesses around you are faltering. When the economy starts to rise again you’ll be able to outspend the competition, giving your brand an even bigger advantage in the post-recession market, notably in areas related to R&D.

As a larger company, you could see a bond yield rating lift with S&P or Moody’s Investors Service, making it easier for your company to secure much more capital.

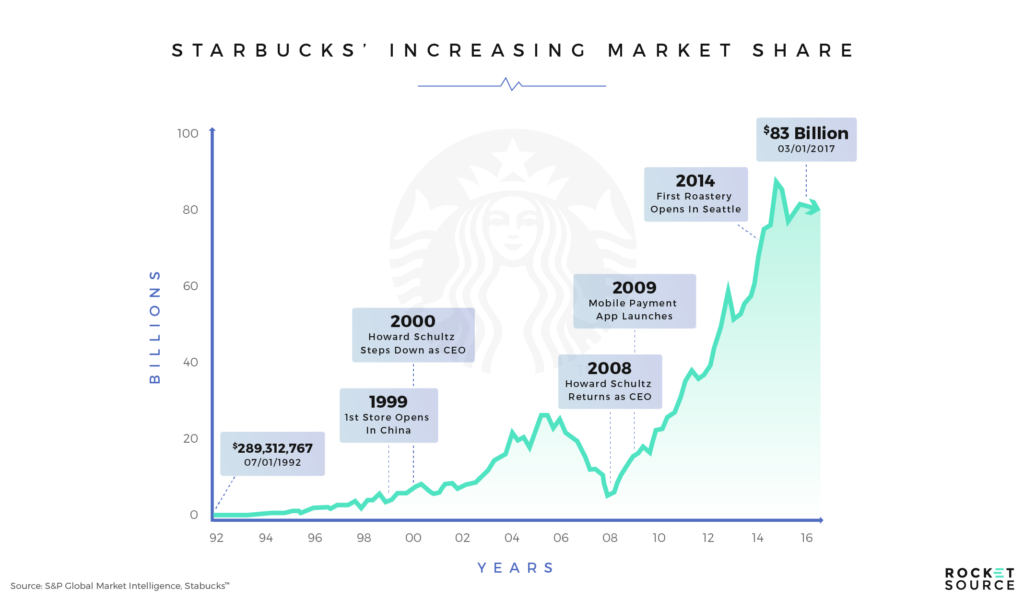

These hypotheticals all sound good (and they are) but have any businesses actually emerged with business-building assets under their belt? You bet. In January 2008, Howard D. Schultz returned to Starbucks as CEO after an 8-year absence. At the time of his return, the company was suffering. Only a month and a half after he took back the reins, profits had fallen by 28 percent. This loss, plus the economic downturn, increased competition from providers of low-cost coffee like McDonald’s, and consumers spending less on indulgent coffee beverages equalled a mess that needed to be cleaned up if the company was to survive. His approach? Rebuild the customer experience.

In the years before his re-emergence as the company’s head executive, Starbucks opened hundreds of shops around the world. This rapid expansion cost the company money, and then profits stalled out. People blamed the economy, but Schultz saw a different problem brewing. He sent a letter to his employees, saying, “The company must shift its focus away from bureaucracy and back to customers.” He went on to say, “The company shouldn’t just blame the economy; Starbucks’s heavy spending to accommodate its expansion has created a bureaucracy that masked its problems.”

Following this analysis, Schultz launched a new initiative. He gave the microphone back to customers to get their feedback. “My Starbucks Idea” began in March 2008. The open innovation design invited customers to share their ideas with the company, giving them a voice and showing them that their opinions mattered to the coffee giant. Consumers jumped at this chance. 93,000 ideas were shared by 1.3 million people on social media. Their page views jumped to 5.5 million per month.

Gathering ideas to increase social media engagement wasn’t the end goal, however. Starbucks had to show they were listening to customer feedback — and they did. They implemented many ideas including the option to pay via a mobile app, adding non-dairy alternatives and rearranging their stores to have more comfortable seating groups. The changes were slight but the message was big. Starbucks showed empathy to their consumers and improved customer experience based on real feedback. As a result, they emerged successfully from the recession.

This initiative wasn’t successful just because they Starbucks solicited customer feedback and ideas and implemented customer suggestions, but also because they emerged from the recession with tremendous assets like brand sentiment lift and brand recall rate.

When consumers have an exceptional experience with your company, they’re more likely to return. As a result, your business is equipped with some pretty attractive assets. As you prepare your recession business strategy, keep this in mind. If you create and build on CX initiatives now, you’ll be prepared when the next recession hits.

Where We Fit In

CX and BX initiatives are powerful — and we offer them to our clients here at RocketSource. We deliver a variety of third party assessments like innovation assessments designed to show areas where our clients can improve. Our StoryVesting framework uses customer experience (CX) initiative data looping to pull out key growth insights in ways similar to the success stories we’ve covered in this article. Regardless of the economic backdrop and future forecasts, we help companies deliver experiences that customers won’t soon forget.

In the quest for a recession-proof business strategy, companies shouldn’t chase after short-term tactics that worked in another economic environment or are knee-jerk reactions. Adopting a customer-centric approach through empathy is vital. So is adopting an internal people-centric approach to establishing, testing and perfecting the 3 Ps — people, processes and platforms. To center your business on people or to plan for how you’ll adapt when the next recession hits, you need to know where you are now. An assessment from a third party gives you an unbiased view of what your organization is doing well, where you can improve and what needs to happen so you can avoid significant job and revenue loss when the economy takes a downward turn. With an innovation assessment in mind and key growth insights in hand, you’re in a prime position to see serious growth.

Ready to take growth into your own hands? We can help kickstart your professional growth and team development to drive your organization to success regardless of the economic backdrop.

The best thing you can do to prepare for the next recession is to not put off the heavy lifting.

Founder/Executive Chairman | RocketSource